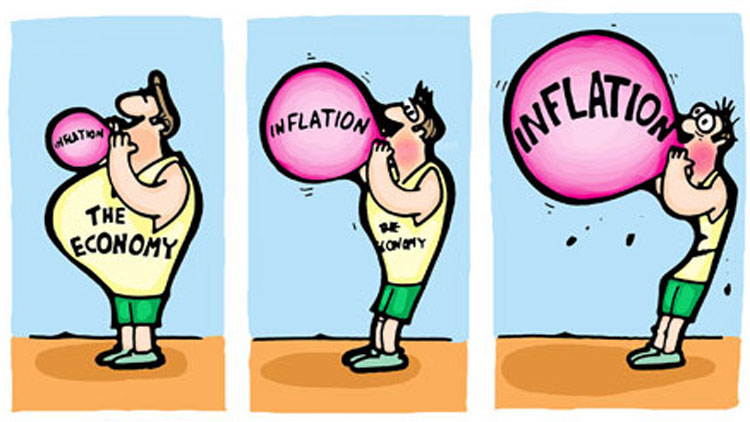

Inflation is a steady increase in the price level of goods and services in a given economy. It corresponds to the erosion of the purchasing power of a currency used within a national or global economy.

In other words, inflation measures how much more expensive a ‘market basket’ of selected goods and services has become over a certain period — usually a year. A rise in the overall level of prices, commonly expressed as a percentage, indicates that a unit of currency now buys less than it did previously — the higher the percentage, the more rapid the erosion of money’s stored value.

Inflation is typically felt more intensely when prices of basic needs rise more quickly than the corresponding increase in basic income. It forces an individual to spend more to buy the same amount of goods and services, which can strain one’s financial muscle.

What Causes Inflation?

Short-term consumer surplus cash availability commonly referred to as a “hot economy,” has a significant impact on inflation. One way to explain this is that individuals may have easy and cheap (low-interest rates) access to credit and wish to use it. If buyers seek specific products and services avidly, the sellers may opt to raise their prices to offset the limited supply.

In the long term, inflation may be impacted by various causes, principally the demand-pull and cost-push impacts. But inflation may fluctuate for causes unrelated to the state of the economy.

As an illustration, factors other than the straightforward ideas of supply and demand contributed to the inflation spike in 2021. First, the framework was set by the epidemic and the general government’s slow reaction to the outbreak.

When COVID-19 came in 2020 and forced the nations of the world to lockdown nearly totally, consumer spending took a fall. On the other side, governments were compelled to spend a lot of money to fill the economic gap. This contributed greatly to the imbalances we see in the global economy today, contributing to inflation.

Consumers began overspending as soon as the economy started to recover. As such, it created a bottleneck with extremely high demand in an already stressed economy, and the systems weren’t ready or well-equipped to manage it – leading inflation to soar higher.

The existing labour scarcity within the market has also contributed to the increasing inflation rates. Reduced labour produces disruption in the supply chain, which in turn drives the cost of products and services higher.

In reality, many factors can trigger an increase in inflation. Here are some of the major causes:

1. Supply-Demand Inflation

Supply-demand inflation happens when the demand is stronger than the economy’s ability to sufficiently supply. When an economy cannot sufficiently meet the demand, the pressure generated pushes prices upwards — causing inflation.

A perfect example of supply-demand inflation is when the UEFA Champions League football tickets for the final went on sale for approximately £500-£700 each. Because of the huge demand for these tickets, they were being sold the next day (on the black market) for £2000-£2500 each.

2. Cost-Push Inflation

Cost-push inflation (commonly referred to as wage-push inflation) happens when the prices increase due to increased production costs, such as an increase in the cost of resources (e.g., building materials) and wages. In order for cost-push inflation to occur, demand for a particular product must stay constant while production cost changes take place. To make up for the change in production costs, the producers push up the prices of their products or services in order to manage profit levels in tandem with anticipated demand.

For instance, food costs are projected to continue rising over the next few months as a result of the rising cost of petroleum in the United Kingdom and the rest of the world. The price of many products and services will probably continue to rise in reaction to rises in petroleum costs since petroleum is a raw material, much needed in many industries. Other causes of this kind of inflation include wars and natural disasters such as floods, fires, pandemics, earthquakes, etc. If war or a natural disaster causes disruption to the supply chain,— for example, unexpected damage to a supply warehouse or production facility — higher production costs are likely to follow.

3. The Housing Market

The property market has had its fair share of price changes throughout the years. Prices will rise if there is a strong demand for real estate as a result of an improving economy. When housing demand declines, the reverse occurs.

The price of auxiliary goods and services that serve the housing sector are also impacted as real estate prices rise; they include items like plumbing supplies, etc., which are also likely to see an increase in cost.

Additionally, there is a strong correlation between overall consumer expenditure and the housing market. Property owners benefit when the value of their properties increases. To fulfil their desire for more goods and services, some people even start borrowing more against the value of their property. This boosts the economy’s demand, which raises inflation.

Similar to how individuals are more inclined to cut down on their expenditures and put off making any personal investments when home prices decline. As a result, inflation is pushed downward and decreased.

4. A Rise in Money Supply

The entire quantity of money in circulation is referred to as the money supply. Supply-demand inflation may occur when the money supply increases more quickly than output. This raises the price of products for both companies and customers, which puts downward pressure on the economy and generates a recession or depression.

Consider this: There’s £1000 and 10 guitars in an economy. If everyone who wanted a guitar were to spend money to buy one guitar, the average price of each guitar would be £100. Now imagine if the money supply in the economy went up by 30% to £1300, but the producers were only able to produce one more guitar. Since the available amount of money is more than the number of guitars available, the average price per guitar will now increase to roughly £118.

A real-life example of an increased money supply is when the Bank of England enacted policies to help combat the financial implications of the pandemic. This led to the BOE minting more pound sterling from scratch to raise the supply of money in the economy.

5. Government Policies and Regulations

When the government issues tax subsidies for specific products, the demand for these products increases, which can then push the prices upwards. This happens if the demand is higher than the supply.

On the other hand, stringent regulations could inadvertently increase costs, thus increasing inflation. For example, if the government bans the importation of showerheads, the prices of showerheads might increase if local producers cannot meet demand.

Governments also use policies and regulations to keep inflation in check. For example, if inflation rises faster than anticipated, a government, through its central bank, can tighten monetary policy by raising interest rates and implementing other hawkish policies. Higher interest rates make borrowing more expensive, reducing consumption and investment, and relying on credit.

Likewise, if inflation and economic activity fall, the central bank will lower interest rates and make borrowing cheaper, among other expansionary policies.

All opinions and views expressed or suggested by the Digital Zeitgeist are not necessarily the same opinions and views held by or suggested by GPM-Invest plus any and all partners, affiliates, parties, or third parties of GPM-Invest. Any type of media distributed by GPM-Invest IS NOT financial advice. Please seek advice from a professional financial advisor