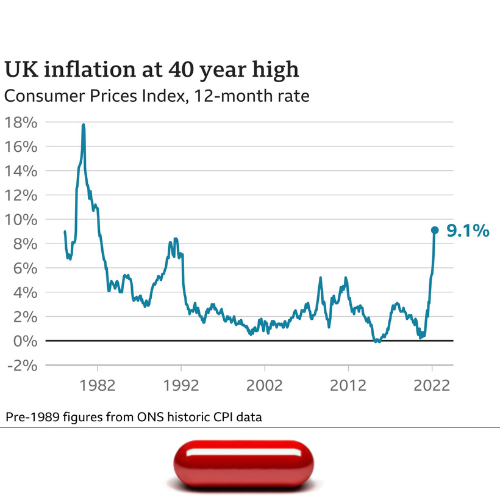

According to data published on Wednesday by the Office for National Statistics (ONS), UK inflation hit a new 40-year high in May as food and energy costs continued to soar.

Consumer price inflation ticked up to 9.1% from 9% in April, in line with analysts’ estimates and hitting the highest level since March 1982.

The ONS said rising prices for food and non-alcoholic beverages, compared with falls a year ago, resulted in the largest upward contribution to the change in both the CPIH (Consumer Price Index with Housing costs) and CPI 12-month inflation rates between April and May 2022.

The data showed that food price inflation rose from 6.7% in April to a 13-year high of 8.5% in May.

ONS chief economist Grant Fitzner said: “Though still at historically high levels, the annual inflation rate was little changed in May.

“Continued steep food price rises and record-high petrol prices were offset by clothing costs rising by less than this time last year and a drop in often fluctuating computer games prices.

“The price of goods leaving factories rose at their fastest rate in 45 years, driven by widespread food price rises, while the cost of raw materials leapt at their fastest rate on record.”

Consumer price inflation grew by 0.7% on a monthly basis in May, compared to a rise of 0.6% in May 2021.

The Bank of England issued a warning that inflation might reach 11% this autumn after raising interest rates to a 13-year high of 1.25% last week. This was higher than the earlier prediction of 10% inflation.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said: “The latest temperature check of the UK economy shows the mercury rising again, with no end yet in sight to feverish price rises.

“May’s rise in inflation was smaller compared to the jump we saw in April, so although the pace of rate rises looks set to continue, the Bank may hold off from bringing in a larger hike of 0.5% for the time being. The pound has slipped back against the dollar, down to $1.22 compared to $1.23 earlier yesterday and worries are mounting that this could flame inflation further by making imported goods even more expensive.”

Paul Dales, the chief UK economist at Capital Economics, said the further rise in CPI inflation in May won’t prevent the Bank of England from raising interest rates further, “but it may encourage it to opt again for a 25 basis point rate hike at its next meeting in August rather than upping the ante with a 50bps hike”.

All opinions and views expressed or suggested by the Digital Zeitgeist are not necessarily the same opinions and views held by or suggested by GPM-Invest plus any and all partners, affiliates, parties, or third parties of GPM-Invest. Any type of media distributed by GPM-Invest IS NOT financial advice. Please seek advice from a professional financial advisor