Digital Zeitgeist – The UK Housing Market: Navigating the Crosswinds of Rate Hikes and Declining Prices

Amidst the turbulent waves of the UK’s financial waters, an unexpected drop in house prices has sent shockwaves throughout the property market. According to Nationwide, house prices tumbled by 5.3% in the year to August. This unsettling descent represents a typical home’s depreciation by £14,600, setting the average property price at a sobering £259,153.

However, this downturn in prices was not entirely unforeseen. The Bank of England’s recent interest rate hikes undoubtedly played a role, pushing mortgage payments upward. As Robert Gardner, Nationwide’s chief economist, observed, the trend was “not surprising.”

The Silver Lining Amidst the Clouds

Despite the tumult, there might be a silver lining for prospective homeowners. With mortgage approvals plummeting approximately 20% below the 2019 average, the housing market’s vibrancy has certainly dimmed. Yet, Mr. Gardner optimistically asserts that “a relatively soft landing is still achievable.”

Supporting this perspective, he highlighted that the current unemployment rate is anticipated to linger below the 5% threshold. Coupled with the fact that a substantial fraction of existing borrowers have secured fixed rates, this could mean the majority can endure the brunt of escalating borrowing expenses.

Furthermore, with a potential combination of swelling incomes and diminishing house prices, the affordability spectrum could see an upswing, especially if mortgage rates start to decelerate.

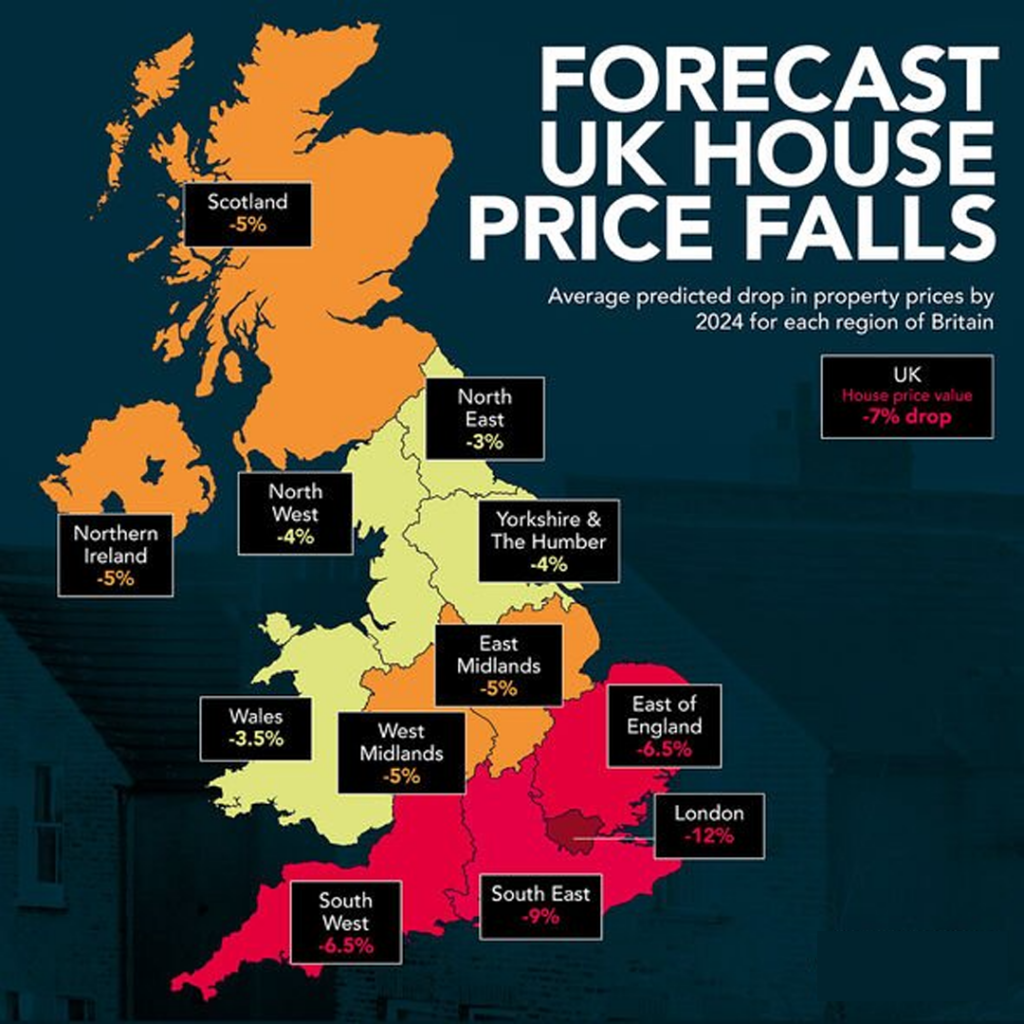

However, not everyone shares Gardner’s hopeful outlook. Andrew Wishart, a senior property economist at Capital Economics, foresees this as the commencement of a “significant further drop in house prices.” He predicts that by mid-2024, prices will plummet 10.5% beneath their zenith in August 2022. The catalyst? Stagnating mortgage rates that linger between 5.5% and 6% over the upcoming year.

The First-Time Buyer’s Quandary

This unsettling landscape presents a dichotomy for first-time buyers. While the notion of reduced house prices seems tempting, the rising mortgage rates could nullify any potential gains. This was underscored by a 25% plunge in first-time buyers in 2023’s first half compared to 2019.

Buyers now face a daunting prospect where monthly mortgage payments could devour a staggering 40% of their net earnings, a stark increase from the historical 29% average.

The Shift in Property Preferences

As the winds of change blow, so do the preferences of potential homeowners. The market has noted a significant wane in demand for detached houses, revealing a trend towards smaller, more affordable property choices.

The Underlying Issues

The challenges don’t end with mortgage rates and property prices. Families grapple with mounting housing bills even as inflation recedes from its peak, a stark reminder of the previous winter when unparalleled energy costs rocked Western economies.

The Bank’s aspiration for a broader economic deceleration to temper price ascensions coincides with its disclosure that mortgage approvals dipped by almost 10% the previous month. Concurrently, Zoopla, a renowned property website, indicated that the UK might close the year with approximately one million house and flat sales — a record low since 2012.

Conclusion: The Devil’s Advocate Viewpoint

While the statistics paint a bleak picture, it’s essential to view this from a broader perspective. Economic cycles have their crests and troughs. A drop in house prices could rejuvenate the market by attracting a new generation of first-time buyers who’ve been previously priced out.

Additionally, the current economic conditions may compel the government and relevant authorities to implement measures to boost the property market. After all, historically, every dip has been followed by a resurgence. For investors and homeowners, patience might just be the key in these trying times.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.