UK inflation hits 7% as fuel prices surge!

March reading is highest in 30 years and increases pressure on Bank of England to raise interest rates again…

Inflation in the United Kingdom climbed to 7% in March, a new 30-year high, as oil prices rose, placing greater pressure on the Bank of England to raise interest rates again.

According to figures released by the Office for National Statistics (ONS) on Wednesday, the increase in consumer prices was up from a 6.2% annual rate in February and ten times the 0.7% reported in March 2021.

The figure was higher than the 6.7% expected by Reuters economists, and it was the most since March 1992, when it hit 7.1%.

The spike in inflation was “broad-based,” according to ONS senior economist Grant Fitzner, who said that one of the biggest increases was in petrol prices, which were primarily collected before the drop in fuel duty announced in the Spring Statement on March 23.

Transport fuel costs increased by 30.7% on an annual basis, following a 9.9% increase the previous month, a near-record monthly increase, as a result of rising international energy prices following Russia’s invasion of Ukraine.

“The sheer scale of this inflation-driven squeeze on living standards makes it all the more remarkable how little support the chancellor provided in his Spring Statement — a decision that will undoubtedly have to be revisited before the autumn Budget,” said Jack Leslie, senior economist at the Resolution Foundation think tank.

Inflation in March was more than three times the Bank of England’s 2% objective, and higher than the “around 6%” pace projected at its most recent meeting. Following the regulator’s hike in the energy price ceiling, the Bank of England predicted that inflation would rise to 8% in April, and possibly higher in the autumn when the cap is next modified.

With inflation consistently exceeding expectations, most analysts now expect it to soar much higher.

Core inflation, which excludes volatile commodities like energy, food, alcohol, and tobacco, increased to 5.7% in March, up from 0.9% the previous month and exceeding experts’ estimates.

Furniture, cooking oil, clothing, household utensils, second-hand automobiles, hotels, and flight tickets all saw double-digit annual price increases. The increase reflects firms passing on more of their increased costs to consumers, while demand in other businesses has rebounded as a result of the relaxation of Covid constraints.

Food costs grew 5.9%, the highest in a decade, with most types of food, such as bread, meat, milk, and fruit, seeing yearly rises of more than 5%.

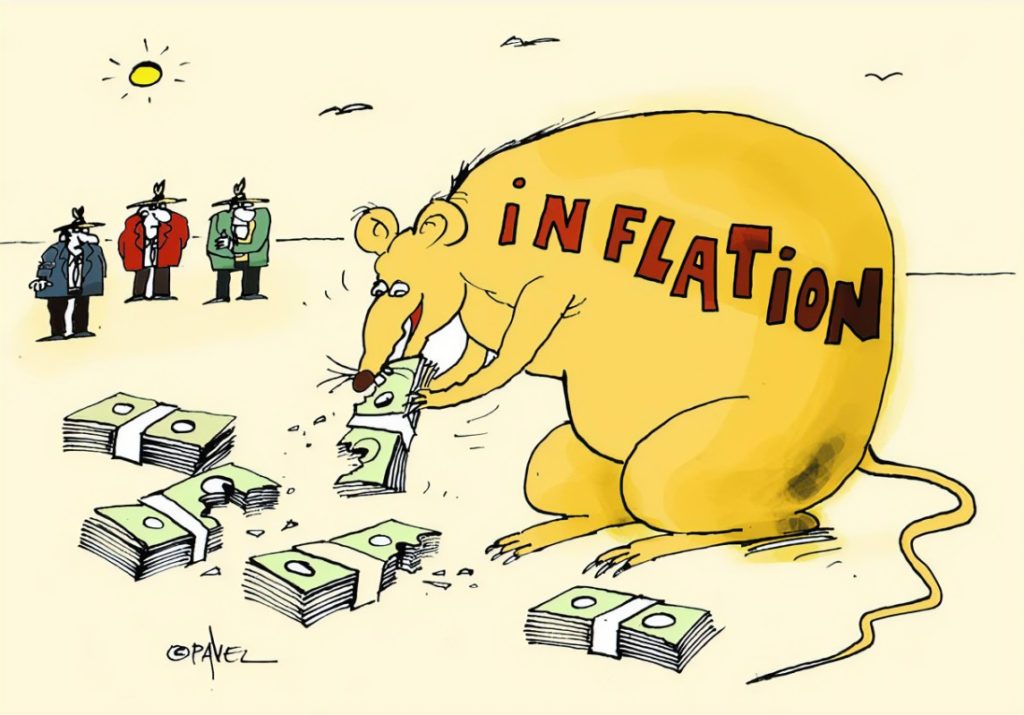

Consumer prices are rising, reducing what consumers can buy with their money, and official data estimate that real income in the UK will fall at the fastest rate since records began in the 1950s this year.

The reading for March is the final inflation report before the Bank of England’s next monetary policy announcement on May 5. Since December, the central bank has raised its main rate three times, from a historic low of 0.1% to 0.75%.

“The figures will put even more pressure on the Bank of England to accelerate interest rate increases, despite the fact that the growth outlook has deteriorated in recent months,” said Dan Boardman-Weston, CEO of BRI Wealth Management.

Interest rates are expected to rise to 1.50% by the end of the year, according to George Buckley, an economist at Nomura.

However, ING economist James Smith predicted “one or perhaps two more rate hikes” because “policymakers are increasingly shifting their focus to the deteriorating growth backdrop.

The latest rise in the consumer prices index, according to the Office for National Statistics (ONS), was the fastest in three decades, coming a month after the gauge for rising living costs surged by 6.2% in February.

With broad-based price increases across the economy, the cost of filling up at the pump rose the most after Russia’s invasion of Ukraine drove global oil prices close to record highs on concerns about supply disruption and sanctions.

Restaurant and hotel costs jumped sharply in March after being unavailable during the lockdown last year, and there were also increases in a variety of food categories as the cost of grocery shopping climbed.

We must keep in mind that these are government-controlled official statistics utilizing their own number-crunching formulas and algorithms. The ‘real’ cost of inflation is much higher. Since Russia invaded Ukraine, fuel at the petrol pump has risen much more than the ‘official’ 7% statistic. It is similar to the ‘real’ cost of feeding and heating our families, whilst quantitative easing is reducing the intrinsic value of savings and cash, financial analysts and professional investors are proclaiming ‘Cash is Trash’!

On Tuesday 12th April 2202, the United States stated that inflation in March reached 8.5%, its highest level in nearly 40 years since 1981.

Online sources: ft.com, theguardian.com All opinions and views expressed or suggested by the Digital Zeitgeist are not necessarily the same opinions and views held by or suggested by GPM-Invest plus any and all partners, affiliates, parties, or third parties of GPM-Invest. Any type of media distributed by GPM-Invest IS NOT financial advice. Please seek advice from a professional financial advisor.