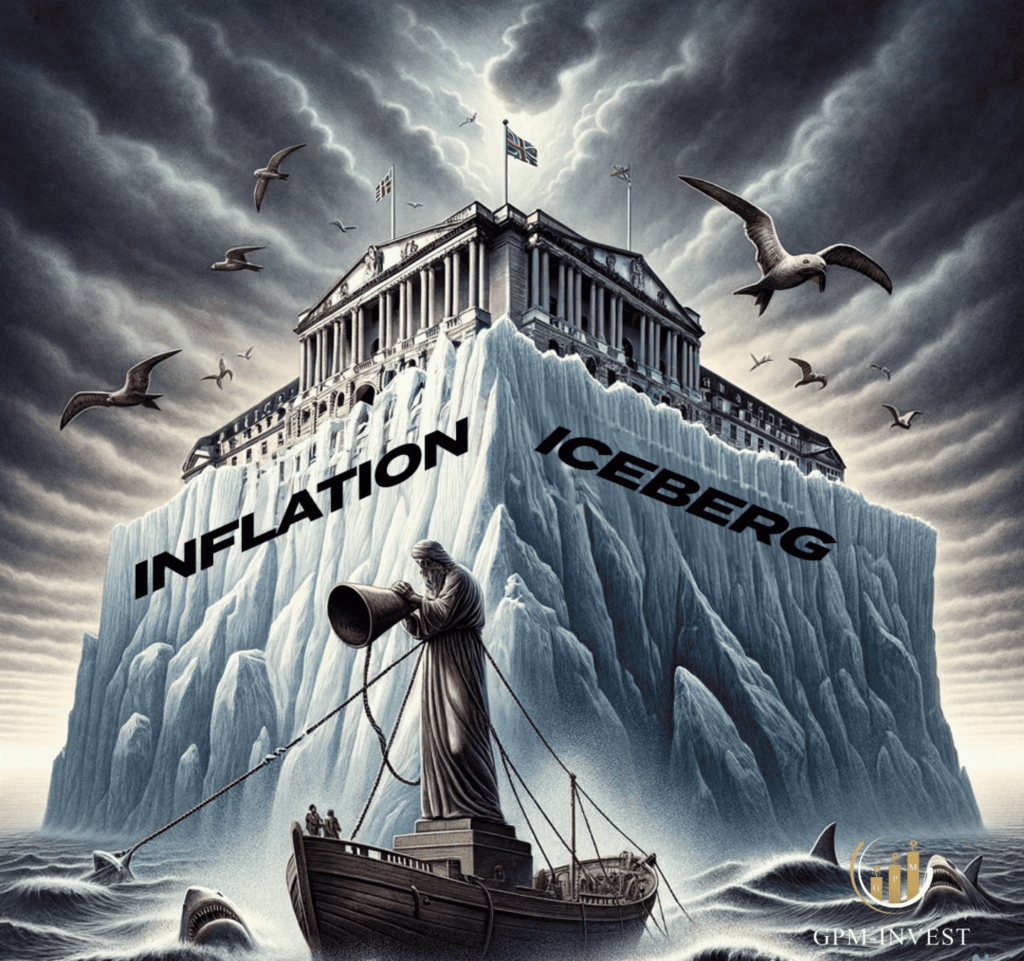

Ignoring the Inflation Iceberg: Bank of England Rings Alarm Bells

By the Digital Zeitgeist, Geopolitical and Financial Analyst based in the UK

Markets’ Blind Spot for Persistent Inflation Risks

In a stark warning to complacent markets, the Bank of England has sounded an alarm over the perilous underestimation of inflation risks. The central bank’s clarion call, highlighting the potential of sustained above-target inflation, resounds through the chambers of the Treasury Select Committee, echoing a message too critical to ignore. The implications of this warning are not just numbers on a page; they are harbingers of a potential financial squall that could destabilise economies and livelihoods on a global scale.

The Inflationary Undercurrents

In the latest discourse with the Treasury Select Committee, the Bank of England’s Monetary Policy Committee (MPC) laid bare the stark reality of inflationary pressures. Despite the headline rate of inflation receding to 4.6% in October, down from 6.7% the preceding month, Governor Andrew Bailey and his colleagues have cast doubts on the markets’ sanguine forecasts. The data may suggest a retreat, but the underlying domestic price pressures—a barometer of economic turbulence—signal otherwise.

This notion is not mere speculation but a reality grounded in figures and economic trends. A dissection of the current data reveals a worrying picture: services inflation stands stubbornly at 6.6%, and wage growth is racing at 7.7%. These numbers are the vital signs of an economy where inflation beats strong and is not in alignment with the Bank’s two per cent target. It’s a target that now appears more a mirage than an achievable milestone, with the Bank’s Monetary Policy Report projecting a return to this rate only by the end of 2025.

The Misjudged Path to Recovery

The markets’ expectations of a dovish pivot from the Bank with interest rate cuts anticipated as early as next summer, with a benchmark Bank Rate of 4.5% by the end of 2024, have been met with a sobering rebuttal. The MPC members have, with repeated emphasis, suggested that such forecasts are premature. Dave Ramsden, Deputy Governor for Markets & Banking, has portrayed the Bank’s prognosis as a more “pessimistic” yet perhaps a more realistic one, especially concerning the supply side challenges.

The stark divergence in opinion between the Bank and the market is not just a matter of different perspectives but could have tangible repercussions on investment, savings, and the broader economic landscape. The “last mile” in curbing inflation, as Ramsden metaphorically describes it, is set to be a hard-fought battle, one that could see a prolonged period of tight monetary policy, impacting businesses and consumers alike.

Beyond the Headlines

The Bank’s analytical lens extends beyond the headline rate of inflation, employing a series of proxies to gauge domestic inflationary pressures. These measures include services inflation and wage growth, which, as the recent data underlines, are far from indicative of an economy cooling down to the targeted inflation rate.

Jonathan Haskell, an external member of the MPC, has pointed out a critical oversight in market calculations—the failure to consider a broader set of inflation measures, which provides a more nuanced and perhaps unsettling picture of the economic realities.

The Perils of Moving Goalposts

Governor Bailey has been unequivocal in his criticism of any suggestions to adjust the inflation target upward; a proposition he dismisses as fundamentally flawed. The target is not just a figure; it is an anchor for economic stability and long-term planning. To shift this target in response to transitory difficulties, Bailey warns, would undermine the credibility of the institution and could set a precedent for future policy flexibility that might exacerbate, rather than alleviate, economic volatility.

Conclusion: A Caution for Global Economies

The Bank of England’s warnings on inflation are not isolated concerns; they resonate with a global audience. The consequences of persistent inflation and the ensuing policy responses have a ripple effect across economies, affecting trade balances, currency exchange rates, and international investment flows. As such, the global economic and financial system stands at a crossroads, where the path taken by central banks like the Bank of England could dictate the financial well-being of nations far beyond its borders.

Ignoring the Bank’s cautions and persisting with a business-as-usual approach could be likened to steering a course straight towards an iceberg, with the inflation warnings the tip that’s visible above the waterline. The real danger lurks beneath, in the shape of entrenched inflation that could capsize recovery and growth. The message is clear: markets would do well to heed these warnings or prepare for the cold reality of an inflationary freeze.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.