Digital Zeitgeist – UK Inflation Rate Continues to Rise Whilst Impacting Mortgage Payments

The inflation rate in the UK has continued to rise, with the latest figures showing a significant increase in March. This has had an impact on many areas of the economy, including mortgage payments. Homeowners are now paying more than ever before for their mortgages, and many are struggling to keep up with the rising costs.

The inflation rate rose to 2.1% in March, up from 1.9% in February. This is the first time the rate has risen above the Bank of England’s 2% target since the start of the pandemic. The increase is largely due to rising oil prices and the impact of Brexit on trade.

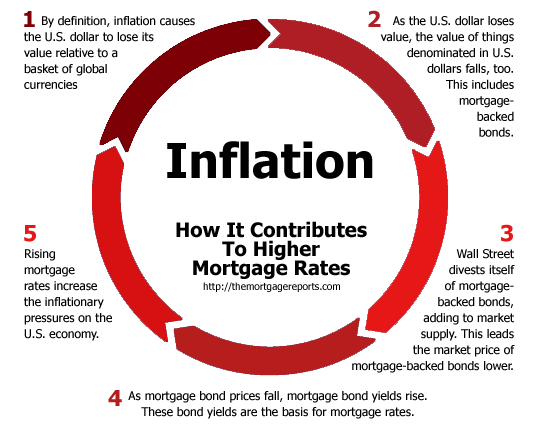

The rise in inflation has directly impacted mortgage payments, with homeowners now paying more for their monthly repayments. This is because many mortgages in the UK are linked to the Bank of England’s base interest rate, which is used to control inflation. As inflation rises, the base interest rate increases, and mortgage payments go up.

Many homeowners are now struggling to keep up with the rising costs of their mortgages. This is particularly true for those who have recently taken out a mortgage or who are on a variable-rate mortgage. These homeowners are more vulnerable to changes in interest rates and are likely to see the biggest increase in their monthly repayments.

However, there are ways for homeowners to mitigate the impact of rising inflation on their mortgage payments. One option is to switch to a fixed-rate mortgage. This type of mortgage offers a fixed interest rate for a set period, which can help to protect homeowners from rising interest rates and inflation.

Another option is to overpay on your mortgage. This can help reduce the amount of interest you pay over the life of your mortgage and help you pay off your mortgage more quickly. Overpaying on your mortgage can be a good option for those who have some spare cash and want to reduce their mortgage payments over the long term.

Despite the challenges posed by rising inflation, there are some positive signs for the UK economy. The rise in inflation is a sign that the economy is recovering from the pandemic, and that consumer demand is increasing. This should lead to further growth and job creation in the coming months.

In addition, the Bank of England has indicated that it will continue to monitor inflation closely and take action if necessary to maintain economic stability. This should help to prevent any significant damage to the economy from rising inflation and interest rates.

Overall, the rise in inflation in the UK has directly impacted mortgage payments, with homeowners now paying more than ever before for their monthly repayments. However, there are ways for homeowners to mitigate the impact of rising inflation, such as switching to a fixed-rate mortgage or overpaying on their mortgage. Despite the challenges posed by rising inflation, there are positive signs for the UK economy, and the Bank of England remains committed to maintaining economic stability.

online sources: news.sky.com, bankofengland.co.uk