Digital Zeitgeist – UK Housing Market Hit by Largest Fall Since 2009: Interest Rate Hikes Worsen Affordability Crisis

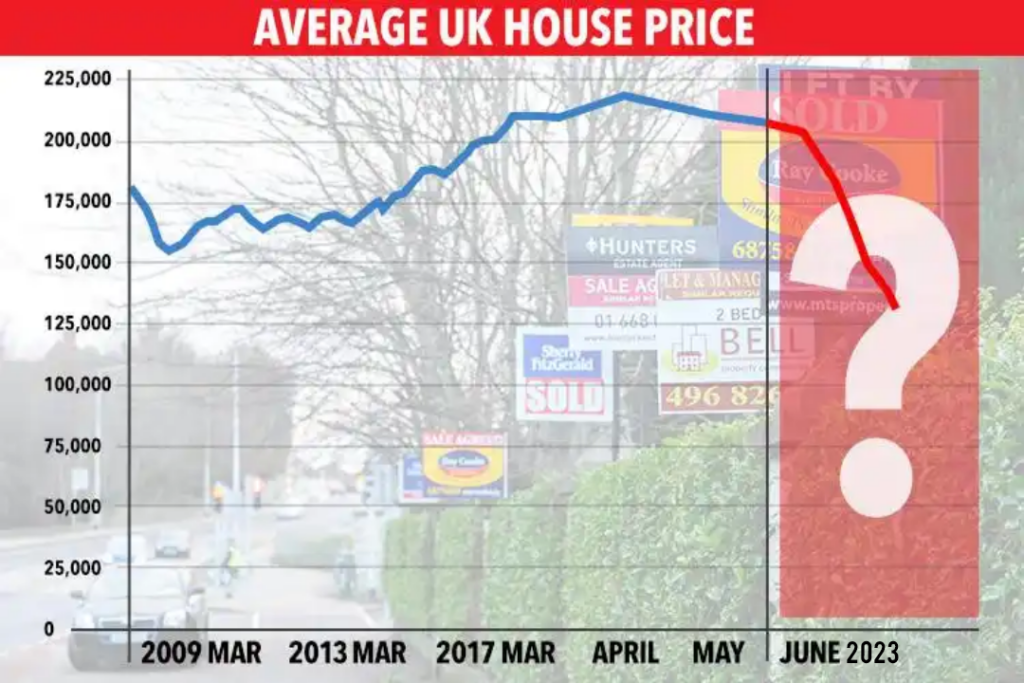

As the UK grapples with the repercussions of a series of interest rate hikes, the housing market finds itself in its most precarious state since the financial crisis of 2009. Prices dropped by a substantial 3.8% year-on-year, marking the most significant annual fall in the past 14 years. A direct consequence of the increasing difficulty for buyers to secure mortgages, the steep decline sends a chilling reminder of the 2009 global recession.

Nationwide Building Society reported the disquieting figures. The last major fall of this magnitude occurred in July 2009 during the worst of the global financial crisis. A 3.5% decrease in June had preceded the latest fall. The price of an average house now stands at £260,828, a 4.5% reduction from the peak recorded in August of the previous year. Furthermore, prices in July saw a 0.2% dip from June.

With the Bank of England incrementally raising interest rates a staggering 13 times since December 2021, in an attempt to curb soaring inflation, the cost of mortgages has seen a sharp upswing. The Bank plans to push the interest rates from 5% to 5.25% this Thursday. As a result, the dream of homeownership has moved out of reach for a significant segment of the population. Those considering remortgaging upon the expiration of their fixed-rate mortgages face potential payment increases of hundreds of pounds.

At the start of the week, the average rate for a two-year fixed deal sat at 6.81%, with a five-year fixed deal slightly lower at 6.34%.

Nationwide’s chief economist, Robert Gardner, illuminated the sobering reality of current housing affordability, describing it as “stretched“. An average earner looking to buy a first-time property with a 20% deposit faces the prospect of monthly mortgage payments amounting to 43% of their take-home pay, given a 6% interest rate. This figure signifies a jump from 32% just a year ago, and significantly surpasses the long-term average of 29%.

Gardner explains this affordability conundrum as a leading factor for the subduing of the housing market in recent months. The market registered 86,000 completed housing transactions in June, representing a 15% drop compared to the same period in the previous year and about 10% below pre-pandemic levels.

While mortgage approval data showed an increase in activity in June, Gardner clarified that these applications likely predate the more recent surge in longer-term interest rates. Data from the Bank of England on Monday revealed mortgage approvals in the UK at their highest level since October, reflecting a rush to secure home loans before any further rate hikes.

Despite these gloomy indicators, Nationwide remains optimistic, stating that a housing crash is unlikely if unemployment stays below 5%. Most borrowers should manage the higher interest rates. Gardner noted, “While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank rate peaks.”

However, economists forecast further declines in house prices. Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, said, “Consumers’ confidence remains well below its long-run average, and expectations that house prices will fall further are well-entrenched. Accordingly, we think that house prices will have to fall by about 8% from their peak before demand and supply come back into balance.”

Adding to the grim projections, Imogen Pattison, an assistant economist at Capital Economics, predicted an additional 7% drop in house prices on top of the near-4% decrease to date. “While we suspect mortgage rates have now peaked, we expect them to stay at 5.5%-6% until mid-2024 when we think the Bank of England may start cutting Bank rate,” she said.

Conclusion: A Devil’s Advocate Perspective

It’s crucial, however, to remember that such a drastic fall in house prices could bring its own silver linings. The soaring house prices of recent years have created significant barriers to entry for first-time buyers. This trend correction could make homeownership more achievable for those currently priced out of the market. The resulting slowdown in the housing market could also drive an increase in rental demand, offering landlords and property investors a strong return on investment.

Another key consideration is the resilience of the UK housing market. It has historically weathered similar storms and bounced back, much like it did following the 2009 financial crisis. The stability and robustness of the market could lend itself to swift recovery once interest rates stabilise and consumer confidence renews.

Moreover, such downturns can stimulate policy intervention aimed at supporting would-be homeowners and the housing market as a whole. Thus, while the current outlook may seem gloomy, the dynamics of economic cycles could lead to valuable opportunities for buyers, renters, and investors alike.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.