Digital Zeitgeist – UAW Strike Sends Shockwaves Through the US Auto Industry: A Call for Economic Justice or a Road to Ruin?

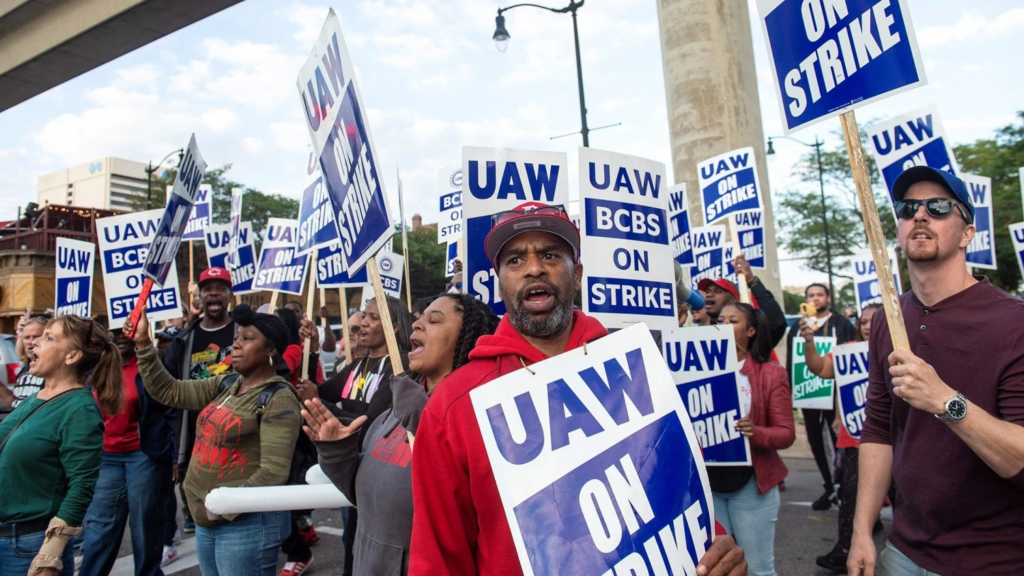

In an unprecedented move, the United Auto Workers (UAW) union has rallied its forces, commencing a labour strike targeting the Detroit Three — Ford, General Motors, and Stellantis, invoking a chapter in the industry’s history brimming with tensions and underlined by a quest for economic justice. This development, the first of its kind in the UAW’s 88-year legacy, not only raises questions on the sustainability of the auto giants but also stirs a maelstrom in the geopolitical landscape, hinting at wider economic repercussions in the global financial system.

The Genesis of the Unrest

Established in 1935, the UAW grew to be a powerhouse in US politics post-World War Two, representing the corridor to the middle class for many through manufacturing jobs in the paramount motor companies of that era. Despite seeing its membership decline from a peak of nearly 1.5 million in 1979 to over 400,000 today, the union still stands as a formidable force, symbolising labour rights across various sectors.

This resurgence of the UAW under the leadership of Shawn Fain, the newly elected president advocating transparency and combativeness, comes at a pivotal moment where labour unrest casts a dark cloud over an industry that forms 3% of the national economy. The strike embodies more than a labour movement; it articulates a broader battle against economic disparities and the burgeoning divide between the workers and the billionaire class.

The Epicentre of the Strike

As it stands, the strike engulfs three significant factories employing fewer than 13,000 workers, with warnings of potential ripples affecting hundreds more due to shutdowns. While currently affecting a minuscule fraction of the companies’ production, industry analysts warn that a prolonged strike could severely disrupt the market dynamics, given the already strained inventory levels, possibly leading to an inflation in car prices.

The Crux of the Contention

With the expiration of the 2019 labour contracts, the UAW brought to the negotiation table a slew of demands including a monumental 40% pay rise over four years, ignited by the glaring discrepancies in the executives’ pay packages, and the companies’ substantial profits and share buybacks.

This bold stance by the UAW, seeking redressal for declining pay power amid surging prices, brings forth the critical dialogue on economic justice. Simultaneously, the industry’s pivot towards electric vehicles (EV) adds a layer of complexity, as the union fears reduced workforce requirements and the deployment of non-union labour in EV production.

As GM CEO Mary Barra quantified the UAW’s initial demands to a staggering $100bn in costs, and Ford’s Jim Farley foresaw potential bankruptcy, the negotiations reflect the tightrope the companies are walking, balancing worker demands and sustainable business models in a highly competitive market, against rivals like Toyota and Tesla, which operate with lower labour costs due to non-unionised workforces.

Geopolitical Ripples and Global Financial Systems

The UAW strike not only holds ramifications for the US economy but paints a grim picture on the global canvas too. Car manufacturing is a highly globalised industry, with a supply chain spanning across continents. A sustained strike could potentially disrupt this intricate network, affecting not just the US but economies worldwide.

Moreover, this strike is unfolding in states holding a disproportionate sway in national elections, inviting scrutiny and statements from incumbent US President Joe Biden and also catching the attention of former President Donald Trump, signalling a possible heightened focus on labour rights in the forthcoming election narrative.

The Road Ahead

Despite the intense negotiations, a consensus seems distant with the UAW ready to escalate the strike if substantial progress remains elusive. Reflecting on the past, the union’s 2019 strike against GM lasted six weeks, hinting at a potential long-drawn battle this time around too.

Given the UAW’s robust financial reservoir to support the striking workers for approximately two months, and with the union president vowing to escalate the strike, the scenario unfolds on a ticking clock, where every second nudges the stakeholders either towards a historic agreement or a potential catastrophe.

Conclusion

The ongoing UAW strike stands at a historic juncture, echoing a powerful narrative of economic justice against a backdrop of global financial systems, holding the potential to reconfigure not just the US auto industry but sending ripples through global economic corridors.

As industry leaders jostle to find a middle ground, balancing workforce demands and sustainable business strategies, the global financial market remains on tenterhooks, foreseeing a chain reaction that could redefine labour rights and corporate responsibilities globally.

With economies worldwide slowly recuperating from the repercussions of the COVID-19 pandemic, a prolonged strike stands to cast long shadows on the global economic recovery trajectory, bringing to fore pressing questions on labour rights, economic disparities, and the evolving dynamics of the modern workforce in a rapidly transforming industry.

As we stand at the crossroads of history, the unfolding chapters of this strike will either pen down a tale of a revolutionary roadmap towards economic justice or be a testimony to a journey that led to an impasse, with global ramifications echoing in economic corridors for years to come. Only time will unfold the true impact of this monumental standoff, yet what remains undebatable is the recalibration of the global financial systems that hinges precariously on the outcome of this landmark negotiation.

Sources:

- UAW historical data and strike updates as of September 15, 2023

- Statements from GM CEO Mary Barra and Ford CEO Jim Farley

- Economic analysis reports on global car manufacturing industry and labour unions.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.