Private equity firms invest billions in dirty energy despite promises to clean up

According to new research, private equity firms investing billions of dollars in dirty energy projects expose investors, especially pensioners, to unknown financial risks as the world burns and governments face increasing pressure to act.

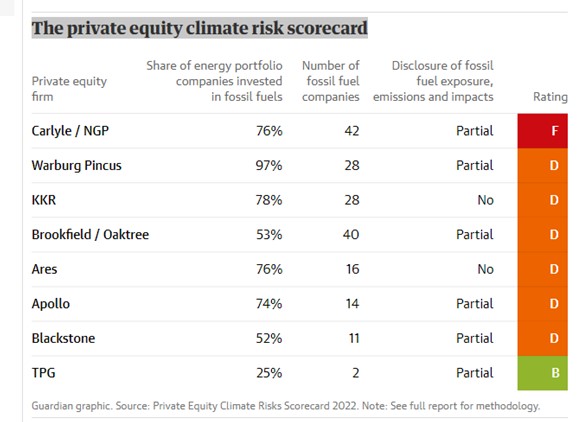

Carlyle, Warburg Pincus, and KKR are the worst offenders among eight big private equity firms with extensive fossil fuel portfolios, according to the first-of-its-kind climate risks scorecard.

According to a review of publicly available data by two financial watchdog non-profits, all three continue to spend substantially on greenhouse-gas-emitting projects with no viable plan for shifting away from oil and gas. According to the research, the corporations’ transparency on political and climate lobbying is also lacking.

Private equity is a form of non-public financing in which funds and investors buy and restructure enterprises such as startups, struggling businesses, and real estate activities.

The eight corporations on the scorecard handle a total of $3.6 trillion in assets, including approximately $216 billion in energy projects – an amount equal to the fossil fuel finance provided by the world’s five largest banks last year.

Carlyle is ranked F, the lowest in the Private Equity Stakeholder Project (Pesp) and Americans for Financial Reform Education Fund’s climate credentials scorecard (Afref).

More than three-quarters of Carlyle’s energy assets are in fossil fuels, and NGP Energy Capital, which focuses almost entirely on oil and gas projects, accounted for just over 60% of its 2022 first-half profits.

Warburg Pincus said last year that it will not pursue more fossil fuel assets in its next purchase, but its dirty energy portfolio has grown since then.

Despite publishing a climate action policy, KKR, one of the world’s wealthiest private equity firms, has stated that it will continue to engage in fossil fuel projects.

According to the analysis, Blackstone is one of the worst downstream polluters, with its power plants producing a combined 18.1 million metric tonnes of planet-warming carbon dioxide in 2020 – equivalent to the annual emissions of over 4 million gas-powered cars!

Higher atmospheric and ocean temperatures are directly related to an increase in catastrophic events such as drought, severe temperatures, and hurricanes, which has cost $152.6 billion in the United States alone in 2021.

“The scorecard provides important information and analysis that can help investors and communities understand what these firms are doing and makes very clear that the firm’s climate commitments are largely empty words”, said Oscar Valdes Viera, research manager at Afref and co-author of the climate risks scorecard.

Private equity handles trillions of dollars’ worth of assets for wealthy individuals and institutional investors including mutual funds, endowments, and pension funds around the world. Since 2010, the business has invested an estimated $1 trillion in the energy sector, and while renewables have grown, the lion’s share remains in oil, gas, and coal.

Private equity businesses, unlike banks and other publicly traded companies, are immune from most financial transparency laws, making it incredibly difficult to track their assets – or risks. This means that ordinary people, such as firefighters, nurses, and teachers, whose pension funds are invested in private equity firms, have little way of knowing if their retirement nest egg is tied up in fossil fuels, which scientists warn must be phased out if global warming is to be minimised.

The Federal Reserve said this week that it will force banks to analyse the impact of the climate catastrophe and energy transition on their long-term financial situation, but the US central bank has no authority over private equity businesses.

The Guardian provided an overview of the industry’s participation in some of the country’s most contentious fossil fuel projects earlier this year. The climate risk scorecard delves deeper into the dangers associated with dirty investments, ranking the worst violators against one another.

Using publicly accessible data, researchers analysed the climate credentials of Carlyle, Blackstone, Warburg Pincus, KKR, Ares, Brookfield/Oaktree, Apollo, and TPG. The scorecard considers numerous transparency indicators, such as emissions disclosure, political lobbying, and energy transition plans – information that investors need to make informed and accurate risk assessments.

Asset managers generally hold firms for five years, allowing them to divest from fossil fuels this decade. However, just one firm, Brookfield/Oaktree (D grade), has published even a partial plan for shifting its portfolio away from harmful energy sources, according to the research. The company’s stated goals include reaching net zero emissions by 2050 after decreasing them by two-thirds across one-third of its assets by 2030. At the moment, fossil fuels account for 53% of Brookfield’s energy portfolio. (Oaktree declined to supply researchers with information.)

“Private equity firms have created large climate risks for the investors providing the capital, especially as they act as fiduciaries of public sector workers’ retirement savings. As societal sentiment grows in support of a clean energy economy, the risk of doubling down on dirty energy assets is becoming clear,” said Riddhi Mehta-Neugebauer, Pesp climate research director.

A spokesperson for Carlyle said: “Carlyle’s approach to invest in, not divest from, the energy transition is a different one, grounded in seeking real emissions reductions within portfolio companies over the long term.”

Warburg Pincus said it was trying to be more transparent about greenhouse gas emissions and that it was “focusing all new energy investments in companies that will benefit from the transition to a low-carbon economy”.

A Blackstone spokesperson said: “We have invested approximately $16bn in projects and companies that are consistent with the broader energy transition over the past three years.”

KKR did not explicitly respond but has previously stated that investing in the energy transition is critical for the environment, economy, and national security.

TPG was the best performer, receiving a B rating due to its minimal quantity of fossil fuel assets.

Online sources: theguardian.com All opinions and views expressed or suggested by the Digital Zeitgeist are not necessarily the same opinions and views held by or suggested by GPM-Invest plus any and all partners, affiliates, parties, or third parties of GPM-Invest. Any type of media distributed by GPM-Invest IS NOT financial advice. Please seek advice from a professional financial advisor