Digital Zeitgeist – Notwithstanding The Chaos In The Market The ECB Goes Ahead And Raises Interest Rates By 50 Basis Points

FRANKFURT (Reuters) – The European Central Bank pushed through another big increase in interest rates on Thursday, sticking to its inflation fight despite turmoil in financial markets that has raised fears about a global banking crisis.

That is a surprise for markets, though, as some investors and economist had expected the ECB to rethink whether such a large increase in borrowing costs was wise in the current situation.

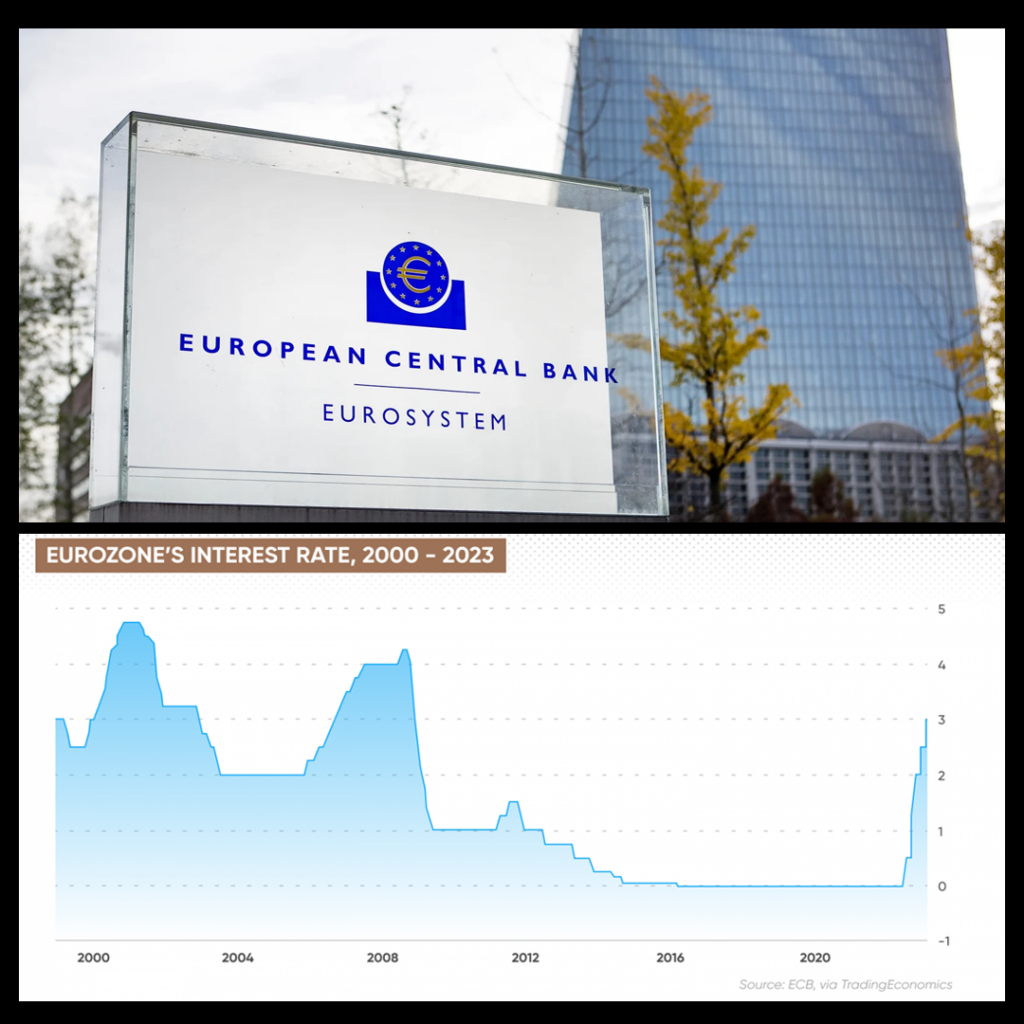

The ECB raised its three policy rates by 50 basis points in its sixth consecutive rate hike and said future moves will depend on incoming data.

“The elevated level of uncertainty reinforces the importance of a data-dependent approach to the Governing Council’s policy rate decisions, which will be determined by its assessment of the inflation outlook,” the ECB said.

The European Central Bank (ECB) decided on Thursday to raise the interest rate it pays on bank deposits, which serves as a benchmark for determining the cost of borrowing money in the euro zone, to 3.0% from 2.5%.

After reaching a high of 8.5% in the previous month, the central banks of the 20 nations that use the euro currency have been embroiled in a battle to bring inflation in the currency bloc back down to their goal of 2%.

But, investors started having doubts about the ECB’s determination to hike rates once more this week as a selloff in the banking sector expanded to include Switzerland’s Credit Suisse, which is a significant institution located on the doorstep of the euro zone.

“The Governing Council is monitoring current market tensions closely and stands ready to respond as necessary to preserve price stability and financial stability,” the ECB said.

It added, “recent tensions imply additional uncertainty around the baseline assessments of inflation and growth”.

On Thursday, the financial markets seemed to have regained some of their composure after the Swiss National Bank provided Credit Suisse with a $54 billion lifeline overnight.

At the press conference that will begin at 13:45 GMT, European Central Bank President Christine Lagarde will undoubtedly be questioned about the turbulence as well as the banking sector in the Euro Zone.

With the increase on Thursday, the rate on the seldom used weekly cash auctions held by the ECB will jump to 3.5%, while the cost of overnight borrowing from the central bank will now be 3.75 percent.

online sources: reuters.com, theguardian.com