Digital Zeitgeist – Holding Steady: Global Central Banks Commit to ‘Higher for Longer’ Amidst Geopolitical Challenges

In a concerted endeavour to alleviate rampant inflation, major global central banks have adopted a ‘higher for longer’ credo, with an overt agenda of keeping interest rates elevated to curb rising prices. The US Federal Reserve, European Central Bank, and the Bank of England, alongside their counterparts from Oslo to Taipei, are now unified in this stance. This comes after a spell of criticism for their alleged tardiness in addressing post-pandemic inflationary pressures, followed by accusations of over-zealous monetary tightening. Nevertheless, with inflation mitigation within grasp, the aim now is to ensure market stability, thwarting premature speculations on rate reductions.

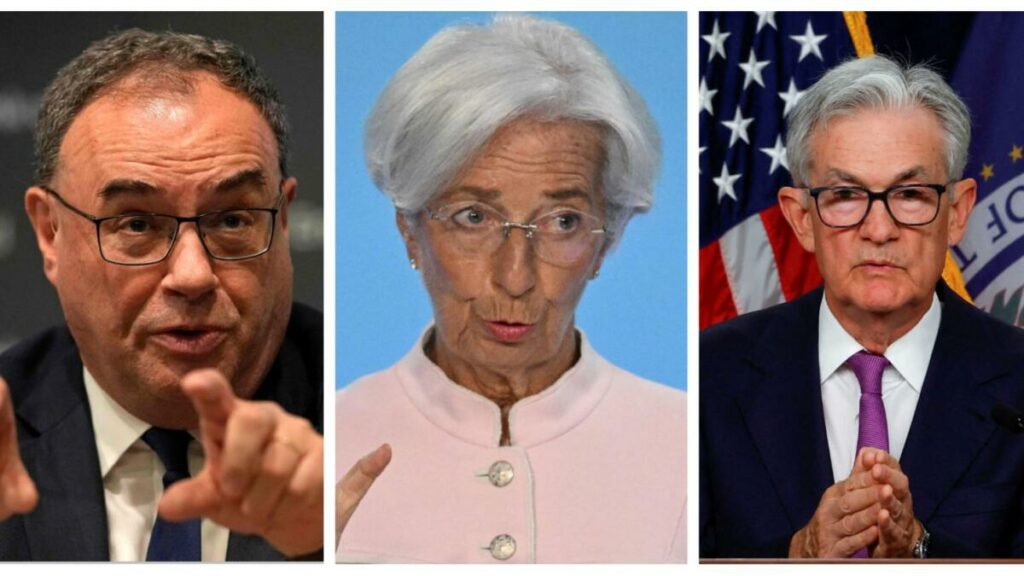

The Bank of England’s Governor, Andrew Bailey, epitomized this sentiment on September 21, affirming the necessity of maintaining a high-interest regime to achieve the desired economic equilibrium. This comes on the heels of a narrow decision to maintain the principal interest rate at 5.25%. Similar echoes resonated from the US Federal Reserve, holding its benchmark rate within 5.25%-5.50%, while expressing a resolute stance against inflation, anticipated to persist until 2026.

Across the channel, ECB President Christine Lagarde delineated that further augmentations of interest rates within the 20-country Eurozone aren’t to be dismissed. This resolve was shared by the central banks of Norway and Sweden, alongside a less assertive Swiss National Bank, content with its modest 1.6% inflation yet not ruling out possible rate hikes.

Diverging from the trend are the Bank of Japan and the People’s Bank of China, both retaining low-interest rates amidst contrasting economic forecasts.

The moniker ‘Tipping Point’ ascribed by Belgian central bank chief, Pierre Wunsch, encapsulates the precise juncture of global monetary policy. The goal is to stabilize inflation rates, which in August hovered at 3.7% in the US and an unsettling 5.2% within the Eurozone, well beyond the nominal 2% target.

However, this global monetary fortitude faces skepticism amidst a clouded global economic tableau, marred by uncertainties around Chinese economic robustness and geopolitical quagmires from the Ukraine conflict to US-Chinese diplomatic tensions. The prognosis by Capital Economics foretells a pivot in central bank policies by next year, with 21 of the world’s 30 major central banks predicted to reduce interest rates. This forecast triggered a mild tumult in global markets, with declining world stocks and a robust dollar, as treasury yields ascended to pre-Great Financial Crisis zeniths.

Emerging economies, beleaguered by onerous debt servicing obligations, find solace in the prospect of global interest rates nearing a pinnacle. The notion of a ‘soft landing’, once a far-flung ideal amidst recessionary forebodings, seems plausible thanks to buoyant labour markets in the US and Europe.

The enigmatic nature of this labour market resilience, possibly attributable to firms hoarding labour to avert skill shortages witnessed post-lockdowns in 2021, leaves policymakers and analysts pondering on the actual strength of the global economy. Bank of Japan’s Governor Kazuo Ueda urges circumspection, sighting unresolved uncertainties.

US Fed Chairman Jerome Powell’s subtle dovish tone amidst the assertive rhetoric reveals an overarching aspiration: a soft landing for the US economy. The delicate balance between inflation control and economic growth elucidates a cautious optimism amongst central bankers, underlining a unanimous recognition of the precariousness of global economic scenario.

Conclusion: The ‘higher for longer’ axiom adopted by global central banks illustrates a synchronous resolve to navigate the inflationary tempest. However, the conundrum of global economic and geopolitical uncertainties muddies the waters. The path to a soft landing is riddled with conjectures and predilections, each move on the global monetary chessboard reverberates through the financial arteries of nations. As central banks tread this tightrope, the spectre of a synchronized global economic policy holds both promise and peril, underlining the exigency of judicious monetary orchestration in the concert of global finance and politics.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.