Digital Zeitgeist – Dividends From UK-listed Firms Up 16.5% In 2022 Far Outstripping Pay Rises

As investors prepare for another increase in borrowing rates this week, the Gross Domestic Product (GDP) of Germany fell by 0.2% in the fourth quarter of 2022, which was worse than projected.

Investors in banks and energy corporations have seen particularly significant increases in their share income.

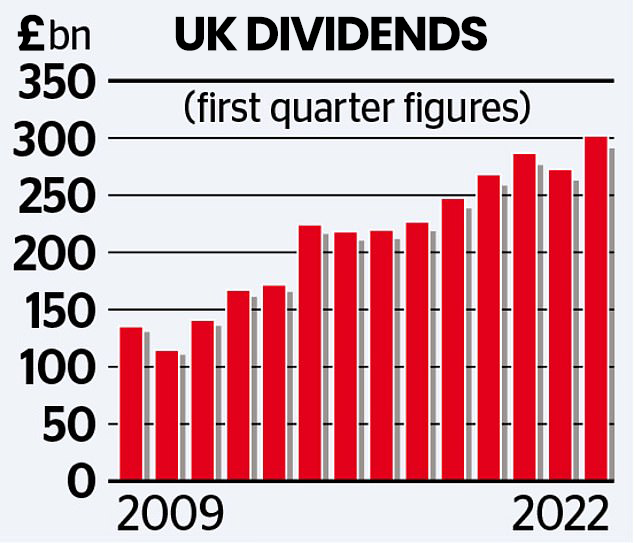

Regular dividends that investors receive as a result of owning shares in UK-listed firms increased by 16.5% in 2022, which is a significant amount more than the growth in wages seen in either the private or public sectors.

Investors’ returns from underlying dividends – excluding volatile one-off payouts – reached £84.8 billion during the year. This was made possible in part by a boost of £3.8 billion from the weakness of the pound, which inflated the figures for dividends paid in dollars. Other factors also contributed to this increase.

The increase in dividend income was particularly dramatic for those individuals who invested in banks and oil companies, both of which were bolstered by the high prices of oil and gas that have led to the current issue in regard to the cost of living crisis.

When the value of one-off dividends, which companies do from time to time to reward investors above and beyond their regular annual payouts, was factored in, the total value was still up, albeit by a more modest 8% to £94.3bn, but it was still an increase. Including the value of one-off dividends brought the total value to £94.3bn.

The growth in shareholder compensation, regardless of whether or not one-offs were included, outpaced the growth in wages by a significant margin.

According to the most recent numbers released by the Office for National Statistics (ONS) for the period covering March to November, wage increases in the public sector have been averaging 3.3%. While the national average for wage growth was 6.4% during the same time period, wages in the private sector increased by 7.2%.

The annual inflation rate in the UK reached a 41-year high of 11.1% in October 2022, and it now stands at 10.5%. Soaring energy prices have been a major factor in the inflation rate over the previous year.

According to the most recent figures from the Link Group, which cover the FTSE All Share index of approximately 600 companies, excluding investment trusts, indicates that costs are increasing at a rate that is faster than wage increases, but not at a rate that is faster than dividend increases.

According to Link Group, the most major factor was “resurgent” banks dividends, which accounted for a fifth of the gain. Oil rewards have increased by a fifth as a direct result of the skyrocketing prices of energy, which have burdened households with extremely expensive bills.

In addition, oil corporations have conducted share buybacks, which is another method of rewarding investors and can help to improve the share price. Shell, for example, has repurchased £16 billion worth of its own shares.

According to Ian Stokes, who serves as the managing director of corporate markets at Link Group in the United Kingdom, “The economic skies are decidedly gloomier both in the United Kingdom and around the world compared to this time last year.”

online sources: theguardian.com, ons.gov.uk, linkgroup.com