Digital Zeitgeist – A Surprising U-turn in Inflation: A Deeper Dive into the UK Economic Outlook

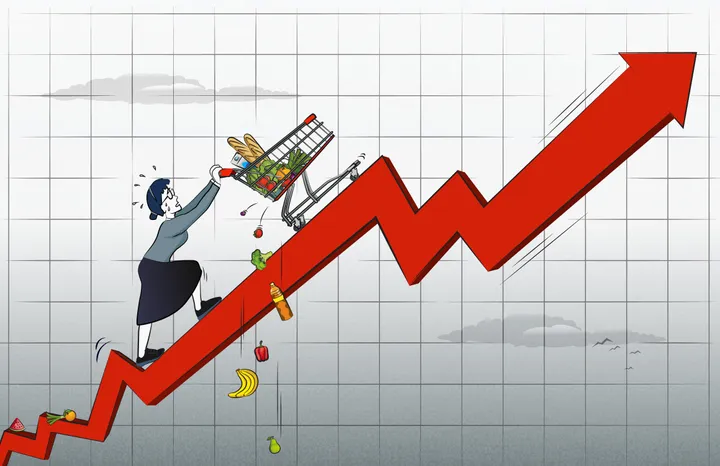

The UK economy witnessed an unexpected turn of events as the rate of inflation fell sharply to 7.9% in June, according to data released by the Office for National Statistics (ONS). This shift, which marks the first considerable reduction since the surge that began in 2020, signals a potentially promising trajectory for the UK’s fiscal outlook.

The ONS reported that the Consumer Price Index (CPI), a key gauge of inflation, fell from 8.7% in May to 7.9% in June. This represents a lessening of price increases rather than an absolute drop in prices. Furthermore, ‘core inflation’, which discounts the impact of volatile elements such as food and fuel, has also dropped from its previous upward trend since January this year to rest at 6.9%.

What underlies this surprising turn? Falling fuel costs, the first dip in raw materials prices since 2020, and a decrease in the rate of food bill inflation have played substantial roles. The price of raw materials dropped by 2.7%, marking the first instance of such a reduction in nearly three years. A slowdown in food price increases also added to this downshift, with food inflation decreasing to 17.3% in June, compared to 18.3% in May.

Additionally, the output prices – the cost of goods leaving factories – saw an impressive decrease, shifting from an increase of 2.7% to a minor growth of 0.1%. This change is noteworthy, considering the ongoing challenges faced by industries due to lingering supply chain disruptions and sourcing difficulties since the latter years of the pandemic.

The Bank of England has been closely monitoring this shift in inflation rates, given its implications for interest rates. Before the inflation announcement, an increase in the base interest rate to 5.5% was anticipated by the majority of analysts. However, this prediction has now been revised to 5.25%, suggesting a milder intervention from the Bank to control inflation.

This change in approach appears linked to the Bank’s decision to raise interest rates 13 times consecutively in a bid to curb economic activity, encourage savings and thereby bring inflation closer to the 2% target. This approach has resulted in a rise in borrowing costs and has led to increased mortgage bills.

However, playing devil’s advocate, there is an alternative perspective that requires consideration. Whilst the recent inflation drop is certainly welcome news, and the government’s plan to halve inflation this year is commendable, it is essential to recognise that this is just a moment in a broader economic context.

Inflation had soared to a staggering 11.1% in October, fuelled by unprecedented events such as the war in Ukraine and the subsequent energy crisis, which sent gas bills to record highs and raised costs across the economy. Furthermore, the predicted peak of the base interest rate, whilst now revised down, still suggests a significant impact on households’ disposable income due to increased mortgage costs and reduced spending power.

Chancellor Jeremy Hunt has acknowledged this reality, stating: “Inflation is falling and stands at its lowest level since last March, but we aren’t complacent and know that high prices are still a huge worry for families and businesses.” The plan to halve inflation this year is a promising step forward but one must acknowledge that achieving this will require continued fiscal discipline and adept economic management.

Therefore, whilst falling inflation rates are indeed a sign of potential stability, it’s worth considering that these are still relatively early days. An economy recovering from an unparalleled pandemic and grappling with geopolitical crises will still have to contend with challenges that could keep inflation higher than the ideal target. However, with judicious decision-making, effective monitoring of core indicators, and a bit of good fortune, the government’s goal of halving inflation within the year might just be within reach.

Moreover, the interest rate dynamics, which are central to the inflation discourse, are themselves affected by a host of factors. In the current context, an interest rate of 5.75% would be a peak in a string of consistent hikes aimed at reining in the rampant inflation. The successive rate hikes have been an effort to balance the economic act, by reducing money in circulation and encouraging savings, thus reducing inflationary pressures.

The interesting shift here is that previously, an interest rate of 6% was considered the most likely peak. However, given the substantial drop in inflation, experts now foresee a revised peak at 5.75%. The less than expected hike in interest rates could mean a little less burden on borrowers and potentially more spending power in the hands of consumers, which in turn could stimulate economic activity.

On the flip side, while falling fuel and raw materials costs have played a role in the inflation drop, they are subject to volatile global markets and geopolitical developments. The aftermath of the war in Ukraine and the consequent energy crisis are cases in point. These events sent gas bills soaring to record highs, pushing up costs across the economy.

Another key factor that has played a role in inflation trends is the supply chain disruption due to the pandemic, which has increased costs for producers, eventually trickling down to consumers. A closer look at the data shows that the price of goods leaving factories saw a modest rise of 0.1%, down from an increase of 2.7% – a reduction but not a drop.

As we continue to recover from the impacts of the pandemic and navigate the geopolitical crisis, it’s crucial to adopt a cautious approach. There is optimism, but it’s laced with a fair dose of caution.

In conclusion, whilst the recent inflation figures suggest an encouraging trend, a devil’s advocate approach would caution against a hasty celebration. The figures indeed indicate a move towards more stable economic times, but the journey towards a fully resilient economy will be long and arduous. The government’s intent, as outlined by Chancellor Jeremy Hunt, of halving inflation this year, though commendable, will need to be followed up with action, resilience, and a fair amount of luck.

It’s fair to say that the welcome news of falling inflation does provide hope for a healthier economic outlook, but it’s a single piece in the complex jigsaw puzzle of economic recovery. Balancing inflation, interest rates, and economic growth, whilst also catering to the welfare of the public, will be the real litmus test of economic management in these testing times. However, with concerted efforts, continued discipline, and perhaps an element of fortune, the year ahead might just yield the desired economic outcomes.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of GPM-Invest or any other organisations mentioned. The information provided is based on contemporary sourced digital content and does not constitute financial or investment advice. Readers are encouraged to conduct further research and analysis before making any investment decisions.