We wait with bated breath to witness more interest hikes from The Fed and The Bank of England (BOE).

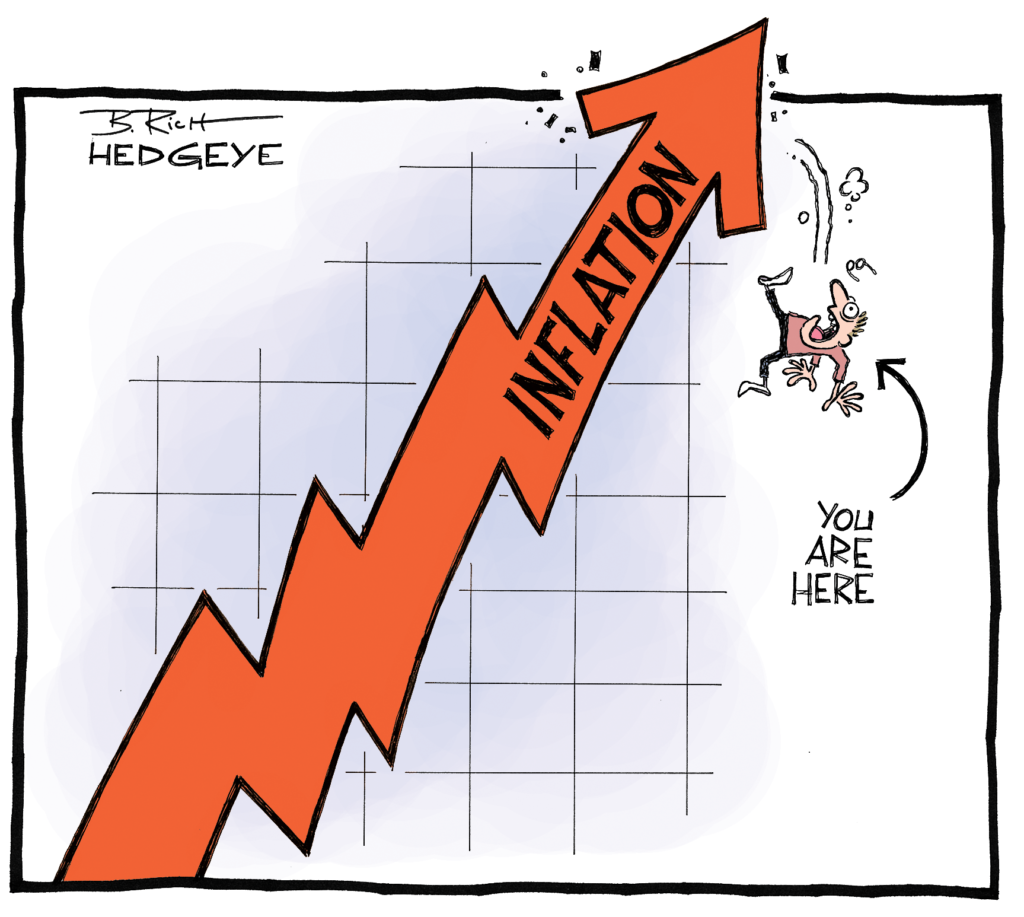

As they step up the fight against inflation, the world’s main Central Banks appear to be planning an aggressive round of interest rate hikes.

The BOE and the Federal Reserve are largely anticipated to increase borrowing prices again this week, signalling that the era of cheap money is over.

The Fed could hike rates by another 0.5 percentage points on Wednesday, after raising them for the first time in three years in March by 0.25 percentage points.

Some anticipate the BOE will follow suit on Thursday with a similar hefty rate hike, albeit a smaller increase from 0.75 percent to one percent is more likely.

That would keep interest rates in the UK at their highest since early 2009. Last December, they were only 0.1 percent. While 0.5 percentage point rate hikes are uncommon, they are not unheard of.

Last month, the Reserve Bank of New Zealand and the Bank of Canada raised interest rates, and they are expected to do so again in the coming weeks.

As they ramp up their fight against inflation, central bankers may want to depict such coordinated strong steps as a ‘show of strength,’ according to analysts.

With households being buffeted by a cost-of-living crisis, inflation in the UK is at a 30-year high of 7%, while it is at a 40-year high of 8.5 percent in the US.

As if it wasn’t hard enough out there at the moment with food costs, petrol prices and gas and electricity prices all soaring, the BOE is likely to make matters worse for householders by inflating mortgage payments again this year.

Interest rates have sat at historic lows for years, with many taking out mortgages and buying homes when base rates were just 0.1 per cent. It meant that many have been able to borrow with a mortgage interest rate of just 1-2%.

But those who took out their deals on a short-term fix could be in for a shock as those rates are set to climb.

Currently, someone taking a mortgage of £250,000 over 25 years at a current 0.75 base rate, would be paying £913.61 per month back.

If the rates went up by 1% to 1.75, that would become £1,028 per month. A raise to 2.75 would be £1,150.73 per month.

Karen Noye, a mortgage expert at Quilter, said: “If you’re coming off a rate between one and two percent where you are locked in a five-year deal and all of a sudden we’re looking at continuous gradual rate increases there’s going to be quite an impact for those people when they come to re-mortgage.”

While most analysts are predicting a rise to one percent next week, some predictions have suggested interest rates could reach as high as three per cent next year.

Sue Anderson of debt charity StepChange warned rising interest rates could begin putting greater pressure on those with debts, particularly mortgages. She told Express.co.uk: “Where this becomes more interesting and more worrying is we might see a more direct impact on people paying their bills perhaps in the mortgage market, where homeowners have not been the highest proportion of our clients for some time… clearly they could see the most direct transmission between a rise in interest rates and a likely rise against their housing costs.”

“So, I think that’s the area that we need to be watching most carefully to see if it does put more pressure on homeowners.”

While raising the base rate in theory impacts a wide range of borrowing Ms Anderson explained many of those with high levels of debt were typically already on high-interest rates meaning the impact would be less obvious here compared to mortgages.

She suggested inflation remained the biggest issue for these households with the rising costs of essential spending leaving the poorest households with little money left over.

online sources: https://www.examinerlive.co.uk/news/cost-of-living/mortgage-hell-warning-bank-england-23839438, thisismoney.co.uk, forbes.com All opinions and views expressed or suggested by the Digital Zeitgeist are not necessarily the same opinions and views held by or suggested by GPM-Invest plus any and all partners, affiliates, parties, or third parties of GPM-Invest. Any type of media distributed by GPM-Invest IS NOT financial advice. Please seek advice from a professional financial advisor.