Digital Zeitgeist – Credit Suisse Sinks 21% After Top Shareholder Rules Out Support

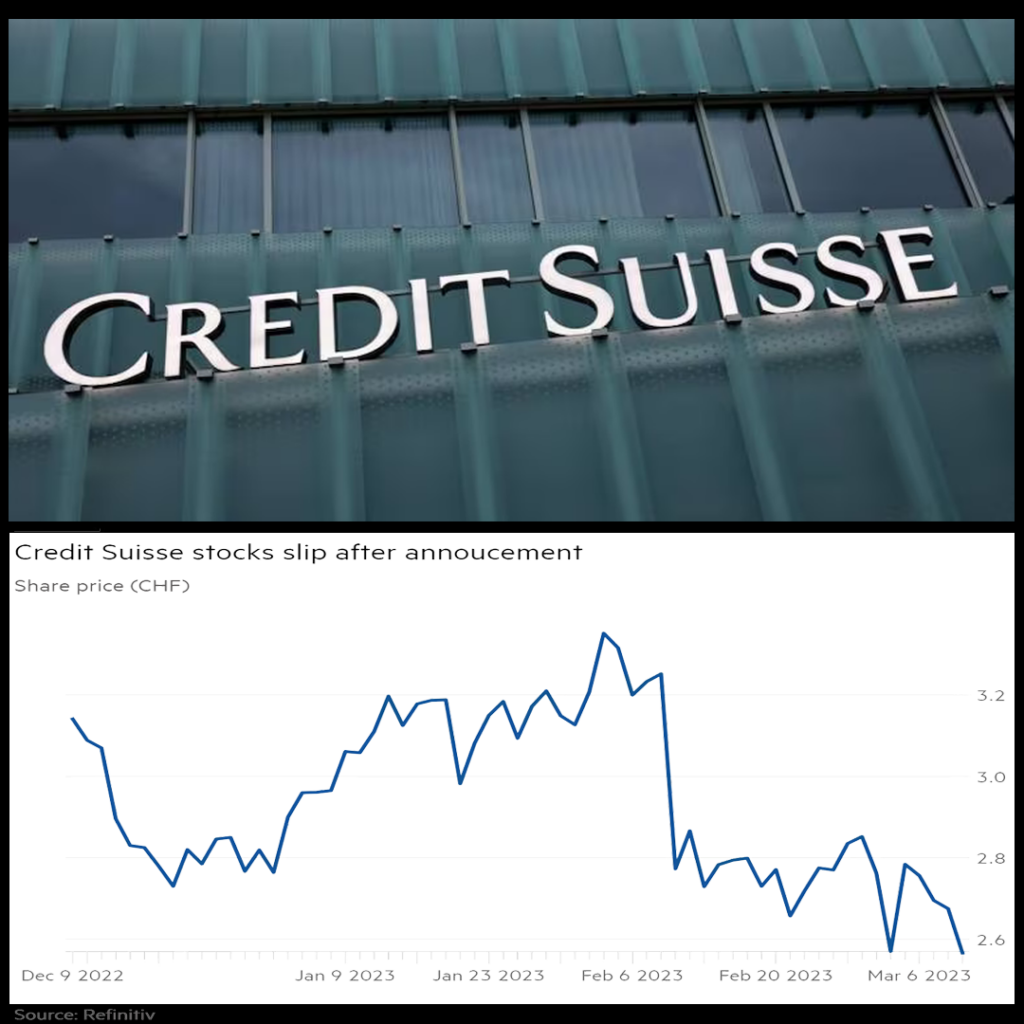

Once the bank’s largest shareholder said that they would not provide any extra support, shares of Credit Suisse Group AG plummeted and the cost of insuring the company’s bonds against failure came dangerously close to a crisis level.

The one-day decline in value of Credit Suisse shares was the largest ever recorded for a single company. At the end of the business day on Tuesday, the one-year credit default swaps were indicated at a price of 835.9 basis points.

The panic selling spread to European banks and dragged US stock futures lower. Two-year yields on German bunds fell 33 basis points, in a further sign of flight to safety.

The Euro Stoxx Banks Index dropped by 7%, hitting its lowest point since the beginning of January, while BNP Paribas SA fell by over 10%.

“Markets are very sensitive to the negative news flow after the surprise of seeing a US bank disappear from one day to the other and the contagion that hit other US regional banks,” said Francois Lavier, head of financial debt strategies at Lazard Freres Gestion.

“In a context where market sentiment is already weakened, not much is needed to weaken it even further,” Lavier added.

Credit Suisse is now in the middle of a complex restructuring plan that will see the Swiss company spin off the investment banking branch while concentrating on its primary wealth management business over the course of the next three years in an effort to bring the bank back to a profitable state.

During the premarket hours, investors sold off shares of major American financial institutions. Both Bank of America Corp. and Wells Fargo & Co. saw their share prices decrease by as much as 3.9% and 4%, respectively. The share price of Citigroup Inc. fell by 3.8%.

Spreads of more than one thousand basis points in one-year senior bank credit default swaps (CDS) are highly uncommon in the credit market. At the worst of Greece’s financial crisis and economic downturn, the country’s major banks continued to trade at around the same levels. The level that was recorded on Tuesday is around nine times the comparable for Deutsche Bank AG, while it is almost eighteen times the contract for the competing Swiss bank UBS Group AG.

The bank’s credit default swap (CDS) curve is also severely inverted, which indicates that it will cost more to insure against an early failure than it would to protect against a default later down the road. Up until last Friday, the CDS curve of the lending institution had a regular increasing slope. Traders would often assign a larger cost of protection to longer periods that include a greater degree of uncertainty.

Its five-year credit default swap (CDS) spreads reached an all-time high as a direct result of the current wave of bearishness that was prompted by the failure of Silicon Valley Bank. With the failure of Silicon Valley Bank, investors are becoming more concerned about the state of the financial sector as a whole.

In an interview that took place on Wednesday with Bloomberg TV, Saudi National Bank Chairman Ammar Al Khudairy said, “The answer is absolutely not, for many reasons outside of the simplest reason, which is regulatory and statutory.” This was the answer that the bank gave when it was asked if it would be willing to provide more injections of capital if there was another request for extra liquidity.

In an earlier interview that took place on Tuesday with Bloomberg Television, Chief Executive Officer Ulrich Koerner said that the business momentum increased during this quarter and that the bank was successful in attracting money after the failure of SVB.

online sources: bloomberg.com, lazard.com